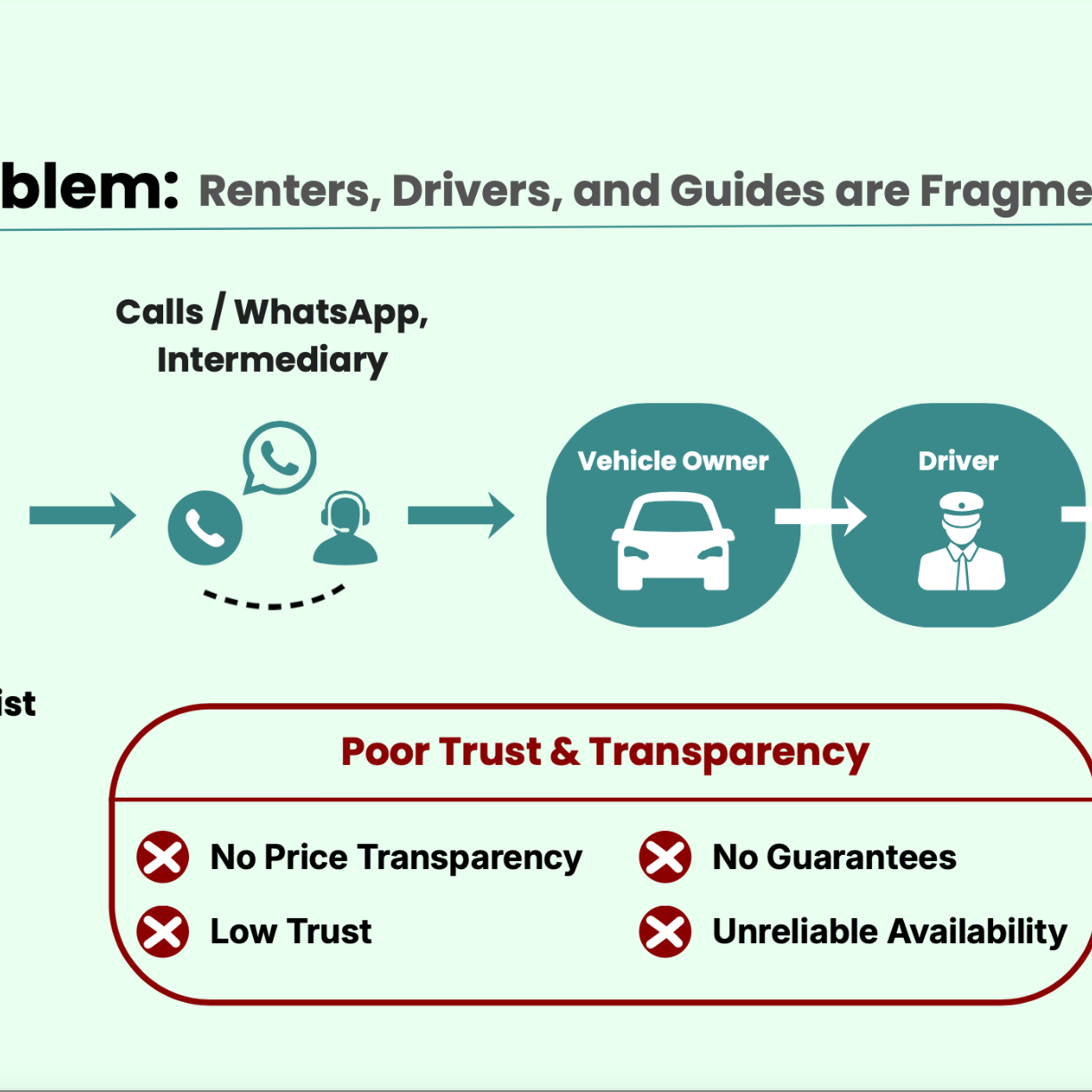

This opportunity involves, a late pre-seed, asset-light mobility and tourism marketplace, seeking strategic partners and investors to support its launch and scale-up in Sri Lanka, with regional expansion potential. The platform enables customers to book vehicles, drivers, and tour guides together or separately through a single trusted digital interface, addressing fragmentation, poor price transparency, and low trust in Sri Lanka’s mobility and tourism ecosystem. With a high-margin marketplace model, no fleet ownership, and a blended ~20% take rate, Rydemor is positioned for rapid operating leverage as tourism and domestic mobility rebound. The company is currently raising LKR 30 million (≈ USD 100,000) at a pre-money valuation of LKR 450–550 million, with funds allocated to product finalisation, mobile app launch, operations, and early growth over an 18–24 month runway. The business demonstrates strong unit economics, a clear path to profitability by Year 2, and scalability across other emerging tourism markets, making it a compelling partner-led investment opportunity at an early inflection point.

Partner-Led Investment Opportunity in a Trust-First Mobility & Tourism Marketplace in Sri Lanka

| Deal Size | |

| Annual Profitability | |

| Net Asset Value | |

| IRR | |

| PBT |

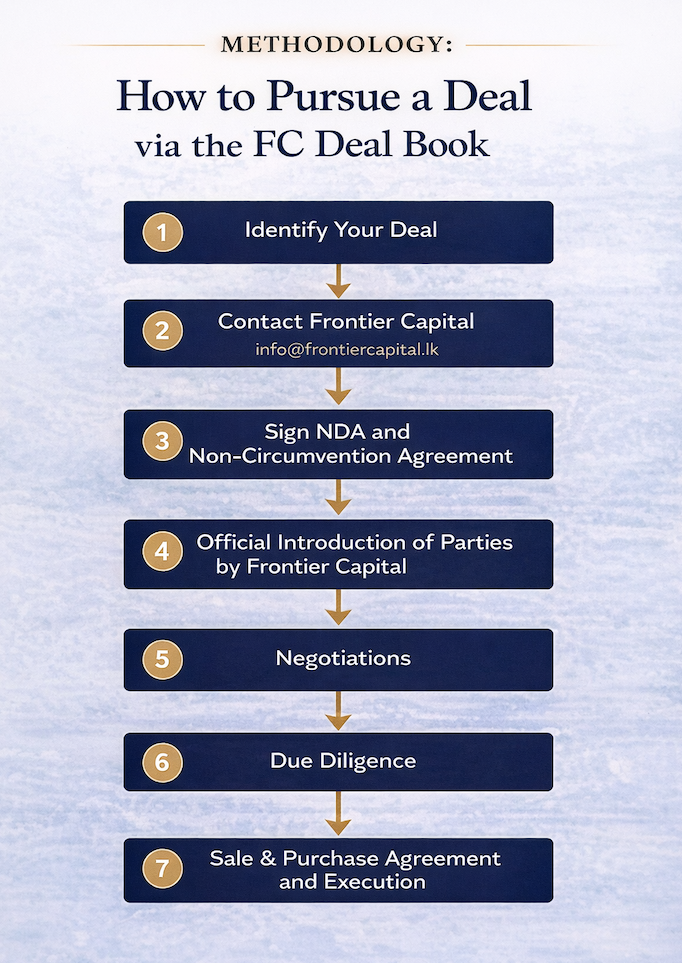

How to Pursue your Deal

The FC Deal Book provides a structured, confidential, and professional pathway for investors and business owners to originate, evaluate, and execute transactions in Sri Lanka. The process is designed to ensure clarity, efficiency, and protection for all parties involved.

Contact: info@dealbook.lk