This opportunity involves the divestment of a controlling interest—up to 100% equity—in a leading Sri Lankan household cable manufacturer with a fully integrated value chain spanning copper scrap sourcing, cathode sheet production, and wire and cable manufacturing. The company has scaled rapidly since commencing operations, surpassing LKR 900 million in revenues, supported by island-wide distribution, strong brand presence, and recently commissioned cathode plant capacity that materially lowers raw material costs and enhances margins. The proposed transaction values the business at approximately LKR 3.6 billion, offering investors the chance to acquire a profitable, asset-backed manufacturing platform with over LKR 2 billion in production facilities, significant operating leverage, and clear growth upside from credit sales expansion, industrial cable entry, export markets, and further cathode capacity expansion. The deal provides immediate control of a cash-generative industrial asset with defensible cost leadership and meaningful medium-term value creation potential.

Control Acquisition Opportunity in a Vertically Integrated Sri Lankan Cable Manufacturing Leader

| Deal Size | |

| Annual Profitability | |

| Net Asset Value | |

| IRR | |

| PBT |

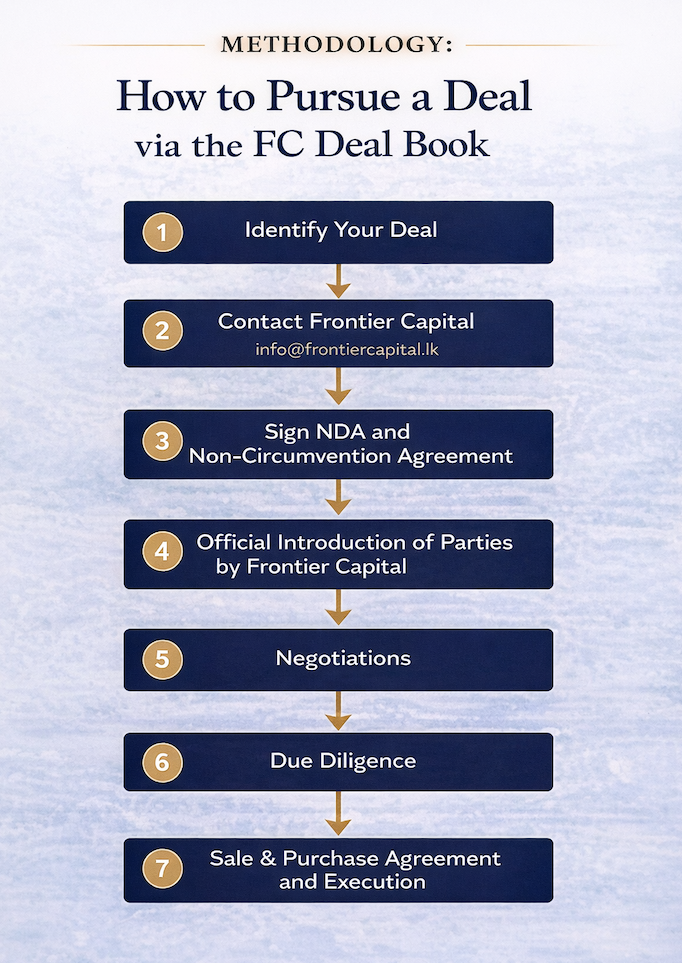

How to Pursue your Deal

The FC Deal Book provides a structured, confidential, and professional pathway for investors and business owners to originate, evaluate, and execute transactions in Sri Lanka. The process is designed to ensure clarity, efficiency, and protection for all parties involved.

Contact: info@dealbook.lk